Dell’Oro just released the Q3 CY2014 SAN Switching Market Share results, and for the second quarter in a row, Cisco came out at #1 in combined FC + FCoE revenue. Only this time, we widened the gap by 9 points! We also took #1 in FC Modular share, with an impressive 11.6% Q/Q share gain. Our FC Fixed share has been growing too, up 8% from a year ago. In all, Cisco has really stepped up its game in SAN Switching.

Cisco market share gains are primarily due to customer acceptance of the MDS product portfolio, ramp up of FCoE-capable products, along with substantial 16G FC demand. FCoE is supported on MDS, Nexus and UCS providing an end to end architecture enabling customers to reduce cost and simplify operations. In the recent quarters, customer buying trends also shifted from buying point products to acquiring pre-packaged solutions. NX-OS a single operating system, and DCNM as single management platform to manage across LAN and SAN, resonated well with customers. Cisco‘s architectural approach of combining storage, network, compute and management helps to reduce cost and increase efficiency.

Cisco Storage Networking – Performance, Flexibility and Availability

Cisco Storage Innovation: Over the last year, Cisco has made significant investments in both FC and FCoE on the MDS and Nexus product lines, and we are starting to see those investments pay off. Last year Cisco introduced a 16G Director (MDS 9710), offering 3x the performance of our competitors’ and also a new Multi Service Platform (MDS 9250i), which we like to refer to as “the Swiss Army Knife” of SAN switching, due to its multi-protocol (16G FC, 10G FCoE, and 10G FCIP ports) and multi-service (SAN Extension, IO Acceleration, and Data Mobility Migration) capabilities. Three months ago we introduced a new compact director (MDS 9706) and a 16G Fabric Switch (MDS 9148S), along with new FCoE enhancements providing customers with deployment choices.

Designing storage infrastructure for new applications requires careful planning. For applications requiring the highest reliability, scalability, and performance, organizations have traditionally deployed Fibre Channel (FC) storage networks and many will continue to do so. FC is still a preferred choice for enterprises (large and small), and the market transition from 4/8 G to 16 G is the best proof that the FC market is still strong.

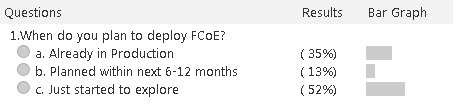

Ethernet-based Storage solutions are also gaining market and mind share, and some of our customers are using Ethernet-based Storage protocols, like FCoE, to reap the benefit of convergence. According to a recent Survey (N = 168), the customers were asked, When do they plan to deploy FCoE: 35% already had it in production and 52% are exploring adoption. As you can see, a lot more customers are considering FCoE for convergence.

A truly converged environment, using FCoE to combine LAN and SAN architectures, can substantially reduce operating costs and simplify management while providing increased performance now and in the future.

Bottom Line

The architectural approach along with strong product portfolio and industry partnership helped Cisco Storage Networking market share continue to maintain #1 position in CY Q3 2014. The newly refreshed Cisco Storage portfolio support the traditional storage architectural requirements for block and file storage along with the new requirements to support big data and object storage for the cloud. The Cisco MDS 9000 Family delivers next-generation solutions for a high performance, multiprotocol SAN.

Cisco is a leader in providing both choice and value for server and storage connectivity! # 1 in FC+ FCoE and #1 in FC Modular Market Share.

For more info: www.cisco.com/go/mds and http://www.delloro.com/products-and-services/san

Tony Antony

Sr. Marketing Manager

CONNECT WITH CISCO

LET US HELP

Call us: 1.800.553.6387 - Ext 118

US/Can | 5am-5pm Pacific Other Countries